The 2008 Financial Crisis: A Comprehensive Analysis and Its Lingering Effects

: A Prelude to Financial Turmoil

The financial crisis of 2008, often dubbed as "The Great Recession," was a pivotal event that shook the global economy to its core. Triggered by a complex interplay of factors, this financial meltdown had far-reaching consequences that continue to reverberate today. This comprehensive article delves into the intricate web of events leading up to the crisis, its impact on the global economy, and the legacy it left behind.

5 out of 5

| Language | : | English |

| File size | : | 39701 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 418 pages |

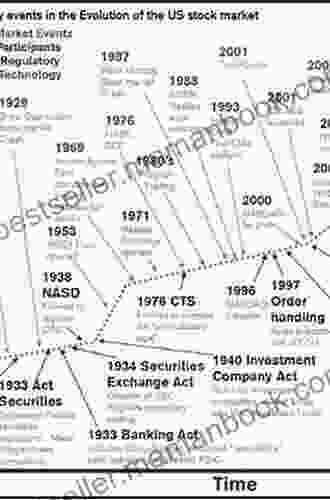

Understanding the Roots of the Crisis

The 2008 financial crisis was a culmination of a series of interconnected factors that created a perfect storm for financial instability. At the heart of the crisis lay the housing market bubble and the proliferation of subprime mortgages. Subprime mortgages, designed for borrowers with poor credit histories and low credit scores, were often characterized by high interest rates and adjustable rates. As housing prices soared, a surge in demand for subprime mortgages ensued. To meet this demand, financial institutions securitized these mortgages, repackaging them into complex financial instruments called collateralized debt obligations (CDOs) and credit default swaps (CDSs).

The widespread issuance of these subprime mortgage-backed securities created a false sense of security among investors. As housing prices continued to climb, ratings agencies assigned high credit ratings to these complex instruments, lulling investors into a false sense of security. However, as the housing market reached its peak, the bubble began to burst. Home prices started to decline, leading to a wave of foreclosures and defaults on subprime mortgages, which in turn triggered a chain reaction of losses throughout the financial system.

The Domino Effect: Unraveling the Interconnectedness

As the subprime mortgage market faltered, the interconnectedness of the financial system became painfully apparent. Financial institutions, heavily invested in these mortgage-backed securities, faced massive losses, putting them on the brink of collapse. The failure of prominent financial institutions, most notably Lehman Brothers and Bear Stearns, sent shockwaves through the markets, further eroding confidence and liquidity.

The interbank lending market, where banks lend to each other to meet liquidity needs, seized up as institutions became reluctant to lend to one another, fearing solvency issues. This liquidity crisis had a domino effect, leading to a rapid contraction of credit and a slowdown in economic activity.

Impact on the Global Economy: A Ripple Effect

The financial crisis of 2008 had a profound impact on the global economy. The United States, the epicenter of the crisis, experienced its worst recession since the Great Depression. Unemployment rates skyrocketed, businesses closed their doors, and consumer spending plummeted. The crisis also had significant spillover effects on other countries, particularly those with close financial ties to the United States.

Europe, in particular, was heavily impacted by the financial contagion. Countries such as Greece, Ireland, Portugal, and Spain, known as the "PIIGS," faced severe fiscal and financial challenges, leading to sovereign debt crises and austerity measures that prolonged economic stagnation. The crisis also affected emerging markets, as investors pulled capital out of these countries, leading to currency devaluations, capital flight, and reduced economic growth.

Government Intervention: Desperate Measures in a Time of Crisis

In response to the escalating crisis, governments around the world implemented unprecedented fiscal and monetary policy measures to stabilize the financial system and prevent a full-blown economic depression. Massive bailouts were provided to ailing financial institutions, interest rates were slashed to historic lows, and stimulus packages were injected into the economy to boost demand and promote job creation. These interventions played a crucial role in preventing a systemic collapse, but they also raised concerns about moral hazard and increased public debt.

Lessons Learned and Lingering Effects

The 2008 financial crisis was a pivotal moment that exposed fundamental flaws in the financial system and highlighted the risks associated with excessive leverage, unregulated markets, and lax lending standards. In the aftermath of the crisis, governments and financial institutions implemented a series of reforms aimed at strengthening the financial system and preventing a recurrence of such a crisis.

Regulation and oversight of the financial industry were significantly enhanced, including the creation of the Dodd-Frank Wall Street Reform and Consumer Protection Act in the United States. Banks were required to increase their capital reserves and maintain higher liquidity ratios. Shadow banking activities, which had played a significant role in the crisis, were brought under closer scrutiny and regulation.

However, despite these reforms, the legacy of the 2008 financial crisis continues to linger. Public trust in the financial system remains fragile, and concerns about inequality and the concentration of wealth have intensified. Economic growth in many countries has remained sluggish, and the scars of the crisis are still felt by individuals and communities around the world.

: A Tale of Caution and Resilience

The financial crisis of 2008 was a profound and traumatic event that left an indelible mark on the global economy. Triggered by a combination of factors, including a housing market bubble, subprime mortgages, and complex financial instruments, the crisis led to a systemic collapse of the financial system and a deep recession. Governments around the world intervened with unprecedented measures to stabilize the financial system and prevent a global depression.

In the aftermath of the crisis, reforms were implemented to strengthen the financial system and prevent a recurrence of such an event. However, the legacy of the financial crisis continues to linger, with concerns about inequality, economic growth, and public trust in the financial system remaining unresolved. The 2008 crisis serves as a cautionary tale about the risks associated with excessive risk-taking, lax regulation, and the interconnectedness of the global financial system. Its lessons continue to guide policymakers and financial institutions in their efforts to promote financial stability and protect the global economy from future crises.

5 out of 5

| Language | : | English |

| File size | : | 39701 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 418 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Jim Ledin

Jim Ledin Charlotte Long

Charlotte Long Carmella Van Vleet

Carmella Van Vleet Marcia Chatelain

Marcia Chatelain Jon Waldman

Jon Waldman Simi Mary

Simi Mary Haruichi Furudate

Haruichi Furudate Frank Wynne

Frank Wynne Steven Konkoly

Steven Konkoly Mary Kennedy

Mary Kennedy Michele Borba

Michele Borba Lee Jacquot

Lee Jacquot Boris Kachka

Boris Kachka Rutger Bregman

Rutger Bregman Aubrey Wynne

Aubrey Wynne Elizabeth Lowell

Elizabeth Lowell Henry Adams

Henry Adams Jean Hines

Jean Hines Bryan Chick

Bryan Chick Richard R Janis

Richard R Janis

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Eugene ScottInspirational Biographies for Children: Inspiring Young Minds with Tales of...

Eugene ScottInspirational Biographies for Children: Inspiring Young Minds with Tales of... Ashton ReedFollow ·8.2k

Ashton ReedFollow ·8.2k Brandon CoxFollow ·12.9k

Brandon CoxFollow ·12.9k Ryan FosterFollow ·17.5k

Ryan FosterFollow ·17.5k Gene PowellFollow ·6.3k

Gene PowellFollow ·6.3k Hugh ReedFollow ·3.6k

Hugh ReedFollow ·3.6k Chandler WardFollow ·14.3k

Chandler WardFollow ·14.3k Colt SimmonsFollow ·15.8k

Colt SimmonsFollow ·15.8k Herman MelvilleFollow ·11.3k

Herman MelvilleFollow ·11.3k

David Foster Wallace

David Foster WallaceA Comprehensive Journey Through Economic Thought: A Brief...

Economics, the study of...

Phil Foster

Phil FosterRecipes for Two: Nourish Your Body, Nourish Your...

Cooking and sharing meals together is one of...

Alexandre Dumas

Alexandre DumasThe Ultimate Monkey Hat: Emery Leeann

If you're an animal lover,...

Chadwick Powell

Chadwick PowellThe Breakbeat Poets Vol. 4: Black Girl Magic - Unveiling...

In the realm of...

Dan Brown

Dan BrownAn Emotional and Touching Love Story: A Journey of Love,...

This is a love story that will stay with you...

5 out of 5

| Language | : | English |

| File size | : | 39701 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 418 pages |