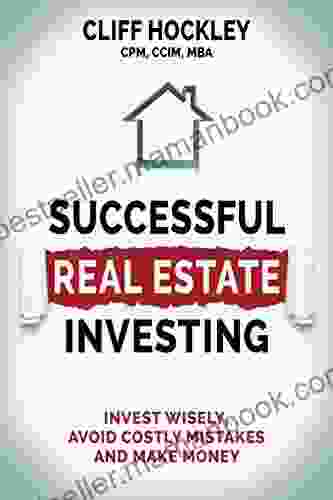

The Ultimate Guide to Successful Real Estate Investing: Strategies, Analysis, and Risk Management

Real estate investing has long been a popular way to build wealth and achieve financial independence. With its potential for high returns, tax benefits, and diversification, it's an investment strategy that can be highly rewarding. However, as with any investment, there are also risks involved. To be successful in real estate investing, it's essential to have a solid understanding of the market, the strategies involved, and the potential risks.

This comprehensive guide will provide you with everything you need to know to get started in real estate investing. We'll cover key strategies, market analysis, financing options, and risk management. By the end of this guide, you'll have the knowledge and tools you need to make informed investment decisions and achieve success in real estate.

5 out of 5

| Language | : | English |

| File size | : | 1293 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 221 pages |

| Lending | : | Enabled |

Key Strategies for Successful Real Estate Investing

There are a number of different real estate investment strategies that you can pursue, depending on your goals, risk tolerance, and financial situation. Some of the most common strategies include:

- Buy-and-hold: This is a long-term investment strategy that involves purchasing a property, renting it out to tenants, and holding it for a period of time. The goal is to generate income from rent and build equity in the property, which can be sold for a profit at a later date.

- Flipping: This is a short-term investment strategy that involves purchasing a property, making repairs and improvements, and then selling it for a profit. The goal is to make a quick return on investment, typically within a year or less.

- Wholesaling: This is a strategy that involves finding and contracting properties below market value, then assigning the contract to another investor for a fee. Wholesaling allows you to make a profit without having to purchase the property yourself.

- Rehabbing: This is a strategy that involves purchasing distressed properties at a discount, renovating them, and then selling them for a profit. Rehabbing can be a more risky strategy than buy-and-hold, but it can also have the potential for higher returns.

- Property management: This is a strategy that involves managing rental properties for other investors. This can be a good way to generate income without having to purchase properties yourself.

Market Analysis for Real Estate Investing

Before you invest in any property, it's essential to conduct thorough market analysis to understand the local market conditions. This includes researching the following factors:

- Median home prices: This is the average price of homes sold in the area. It's a good indicator of the overall health of the market.

- Days on market: This is the average number of days that homes stay on the market before they sell. A long days on market time can indicate a weak market.

- Inventory levels: This is the number of homes available for sale. A high inventory level can indicate a buyer's market, while a low inventory level can indicate a seller's market.

- Interest rates: Interest rates have a significant impact on the affordability of homes. Rising interest rates can make it more difficult for buyers to qualify for mortgages, which can lead to a slowdown in the market.

- Economic factors: The local economy has a big impact on the real estate market. Strong economic growth can lead to increased demand for housing, while economic weakness can lead to decreased demand.

Financing Options for Real Estate Investing

There are a number of different financing options available for real estate investors. The best option for you will depend on your financial situation and investment goals. Some of the most common financing options include:

- Mortgage: A mortgage is a loan that is used to purchase a property. Mortgages are typically amortized over a period of 15 to 30 years.

- Home equity loan: A home equity loan is a loan that is secured by your home equity. These loans typically have lower interest rates than mortgages, but they also come with a higher risk of foreclosure.

- Hard money loan: A hard money loan is a short-term loan that is secured by the property being purchased. These loans typically have high interest rates, but they can be a good option for investors who need to close quickly or who have less-than-perfect credit.

- Private lending: Private lending is a way to borrow money from an individual or company instead of a bank. Private lending can be a good option for investors who have difficulty qualifying for traditional financing.

Risk Management in Real Estate Investing

As with any investment, there are risks involved in real estate investing. Some of the most common risks include:

- Property value decline: The value of your property can decline for a number of reasons, such as a recession, a change in the local economy, or a natural disaster.

- Vacancy: If you are renting out your property, you may experience periods of vacancy when you are not able to find tenants. This can lead to lost rent income and additional expenses.

- Maintenance and repairs: All properties require maintenance and repairs on a regular basis. These costs can add up over time, so it's important to budget for them.

- Legal issues: There are a number of legal issues that can arise in real estate investing, such as disputes with tenants, contractors, or other investors.

- Lack of liquidity: Real estate is not a liquid investment, meaning it can take time to sell your property when you need to. This can make it difficult to access your money in the event of an emergency.

Real estate investing can be a powerful tool for building wealth and achieving financial independence. However, it's important to understand the market, the strategies involved, and the potential risks before you get started. By following the advice in this guide, you can increase your chances of success and avoid the common pitfalls of real estate investing.

If you are thinking about investing in real estate, it's important to do your research and talk to a qualified professional. A real estate agent or financial advisor can help you understand your options and make informed investment decisions.

5 out of 5

| Language | : | English |

| File size | : | 1293 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 221 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Jim White

Jim White Brooke Shields

Brooke Shields Audrey J Cole

Audrey J Cole Mary Beth Keane

Mary Beth Keane Maxim Ross

Maxim Ross Philip Donlay

Philip Donlay Elyn R Saks

Elyn R Saks Gabrielle Zevin

Gabrielle Zevin J F Penn

J F Penn Dr Javier Gonzalez

Dr Javier Gonzalez Stephanie Albright

Stephanie Albright Lily J Adams

Lily J Adams Marv Wolfman

Marv Wolfman M Z Sereda

M Z Sereda Marcia Chatelain

Marcia Chatelain Sybilla Beckmann

Sybilla Beckmann Jack Holder

Jack Holder Virginia Nylander Ebinger

Virginia Nylander Ebinger Marcus Youssef

Marcus Youssef Maria Wheatley

Maria Wheatley

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Andres CarterThe Best Accelerated Learning Techniques to Learn More, Improve Memory, and...

Andres CarterThe Best Accelerated Learning Techniques to Learn More, Improve Memory, and... Julian PowellFollow ·9.9k

Julian PowellFollow ·9.9k Jaylen MitchellFollow ·2.1k

Jaylen MitchellFollow ·2.1k Marc FosterFollow ·8.9k

Marc FosterFollow ·8.9k Miguel de CervantesFollow ·5.6k

Miguel de CervantesFollow ·5.6k Ernest HemingwayFollow ·17.9k

Ernest HemingwayFollow ·17.9k Andres CarterFollow ·3.6k

Andres CarterFollow ·3.6k Douglas FosterFollow ·7.3k

Douglas FosterFollow ·7.3k Benji PowellFollow ·15.5k

Benji PowellFollow ·15.5k

David Foster Wallace

David Foster WallaceA Comprehensive Journey Through Economic Thought: A Brief...

Economics, the study of...

Phil Foster

Phil FosterRecipes for Two: Nourish Your Body, Nourish Your...

Cooking and sharing meals together is one of...

Alexandre Dumas

Alexandre DumasThe Ultimate Monkey Hat: Emery Leeann

If you're an animal lover,...

Chadwick Powell

Chadwick PowellThe Breakbeat Poets Vol. 4: Black Girl Magic - Unveiling...

In the realm of...

Dan Brown

Dan BrownAn Emotional and Touching Love Story: A Journey of Love,...

This is a love story that will stay with you...

5 out of 5

| Language | : | English |

| File size | : | 1293 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 221 pages |

| Lending | : | Enabled |